Payroll: States With Special Tax Factors

Jump to navigation

Jump to search

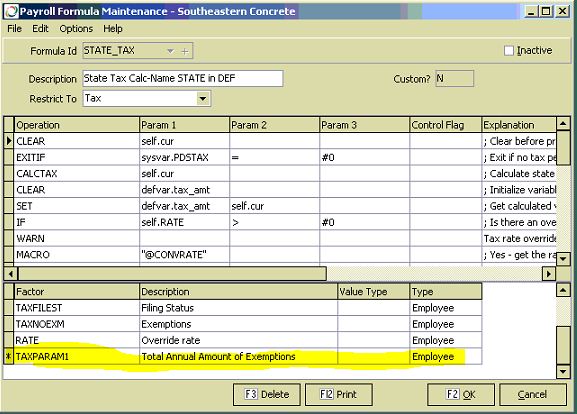

Some states, for example Alabama, require special additional factors for the Tax Library. These factors, known to Keystone as TAXPARAM1 and TAXPARAM2 can be setup in Tax Code Maintenance and/or as factors in the Payroll Formula Setup.

States with known additional factors

- AL

- AZ

- LA

- MS

Tax Code Maintenance Setup

Plug the needed factors 1 and 2. Do not specify the rate type.

Alabama

- TAXPARAM1: Set to 100 for employees to take the personal exemption

- TAXPARAM2: Set to 1 for married employees to assume Married Joint. Otherwise the tax will default to Married Separate, resulting in a much higher tax.

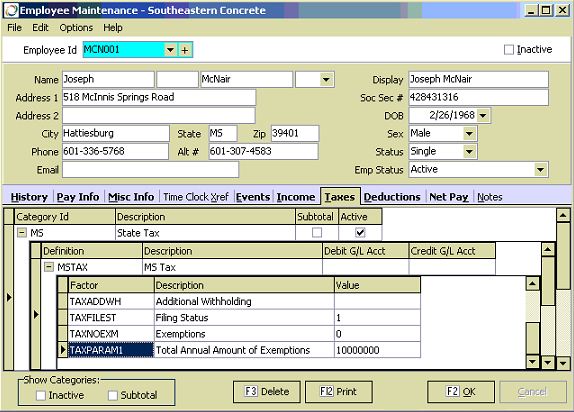

Mississippi

1. Add TAXPARAM1 to STATE_TAX formula

2. Enter the total annual amount of exemptions. For example enter $1,700.00 as 17000000

Louisiana

TAXPARAM1 should be set as follows:

- 0 = no personal exemption

- 10000 = one personal exemption

- 20000 = two personal exemptions