Payroll: Company Healthcare Reporting

Beginning with the payroll year 2011, the employer’s contribution to each employee’s health insurance is reportable on the W-2s for informational purposes. We are adding a formula and strategy to handle this scenario.

It should be communicated to the customer that they are responsible for determining which company insurance plans are to be reported and the company paid amounts that are setup in the payroll system. General information is provided here, but this is an issue for the customer’s CPA if they need assistance.

Here are a couple of links for what is to be reported and what is the significance. These would be good links to share with customers if they need more information.

Evidently there is some bad information about Health benefits being taxed. See:

Keystone Payroll Definition

Companies generally receive a Monthly Invoice for Employee’s Health insurance broken down by employee. The total monthly insurance cost will be entered for each employee (can be changed from month to month). The formula will record into Payroll History (prtempdefhst);

- 1. The monthly cost for insuring each employee as def_id HLTINSCOST

- 2. The total of health insurance deductions (i.e. the employee paid amount) as def_id HLTINSEMP

- 3. The company paid portion (i.e. cost for employee less employee paid amount) as def_id HLTINSCO

Setup –

- 1. Upgrade to version 2.4.XX.

- 2. Run Year End Modifications from Payroll>Year End

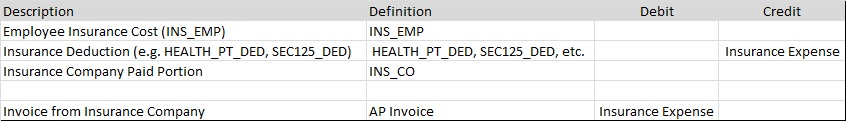

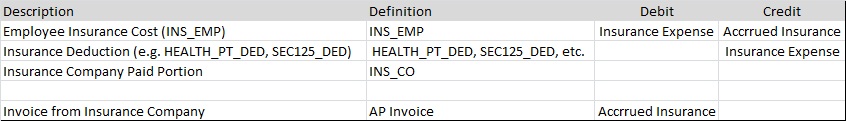

- 3. General Ledger (Optional)– Set GL accounts according to 1 of the scenarios below: