Taxable Benefit 0 Check: Difference between revisions

Intra>User m (1 revision imported) |

m (1 revision imported) |

Latest revision as of 13:00, 14 July 2023

Overview

See also Payroll: Taxable Benefits

The TAXBEN Income and Deduction allows adding an amount to an employee's taxable gross without making a cash payment. Using TAXBEN is preferable to adjusting employee balances for end of year Taxable Benefit posting in terms of:

- Calculating and posting taxes (especially Social Security and Medicare for both the employee and company portion)

- Creating a proper audit trail in the system.

This page goes through the process for running a net 0 check for a Taxable Benefit posting when there is not a normal payroll amount to deduct the taxes from.

Setup

- Activate TAXBEN and TAXBENDED in Company Maintenance on the Income and Deductions tab. Enter the "Payroll Expense" GL number in TAXBEN (debit) and TAXBENDED (credit). Use the same GL number for TAXBEN and TAXBENDED.

- Activate TAXBEN and TAXBENDED in Employee Maintenance on the Income and Deductions tab.

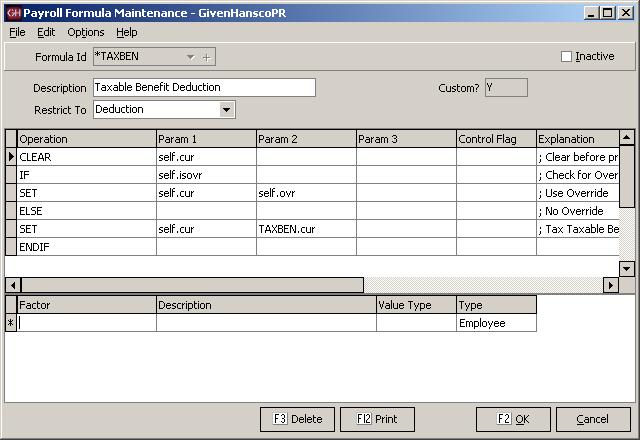

- Modify the Payroll Formula *TAXBEN to check for and use override an value.

Processing

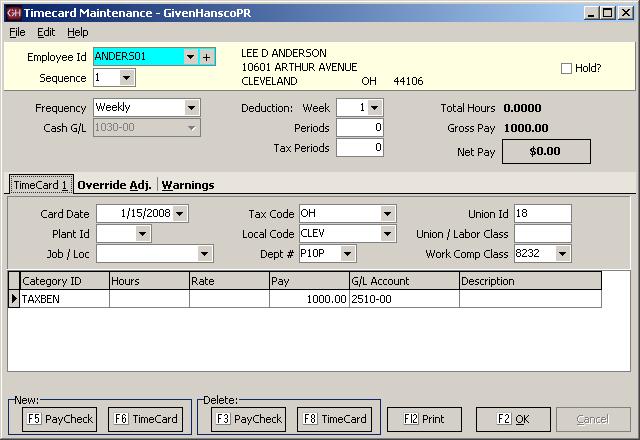

- Setup Payroll with 0 for Deduction and Tax Periods. (This example assumes the only deduction will be Social Security/Medicare).

- Enter Timecard(s). The TAXBEN line will be the amount of the Taxable Benefit.

- Click Calculate.

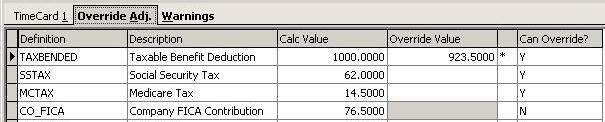

- Check the Override Adj tab.

- Override any unwanted deductions to 0.

- Override the TAXBENDED to TAXBEN - [any deductions]. In this example TAXBENDED = TAXBEN - SSTAX - MCTAX (i.e. gross-deductions i.e. the amount require to balance the GL transactions and set the check amount to 0)

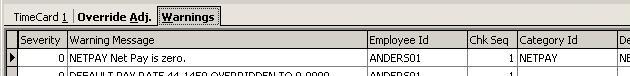

- Check the Warnings tab. This should indicate NETPAY = 0. If NETPAY is positive or negative, the override is not correct.

- Calculate Payroll, run reports and print (0) check(s).

Note on Gross

This procedure is an improvement of the previously posted procdedure in that the Employee's Gross pay is the expected amount (the previous GROSS plus the amount of the Taxable benefit in this payroll). While both procedures resulted in a proper withholding for Social Security and Medicare, the previous procedure required adding an amount to the gross pay to cover the additional Social Security and Medicare tax that was generated.

Note on GL Transactions

This revised procedure results in different values for TAXBEN and TAXBENDED. For W-2 purposes the TAXBEN is the amount reported for earnings and TAXBENDED is not needed. The GL is balanced by a net debit to "Payroll Expense" (the difference between TAXBEN and TAXBENDED) offset by the credit(s) to "Accrued SS/MC Tax withheld".